News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Pi Network (PI) Bounces Off Key Support – Is a Breakout Ahead?2Cardano Price Prediction 2025: Will BTC Integration Push ADA Price to $3 or $5?3Is Ethena (ENA) in the Final Accumulation Zone Before a Reversal? This Fractal Says Yes!

What Is Yield Farming and How Does It Work in DeFi?

Cryptotale·2025/04/06 02:00

Cardano’s ADA First 'Death Cross' in 2025 Fast Approaching: What’s Next?

CryptoNewsNet·2025/04/06 01:11

Polymarket Bettors’ Recession Odds Surge Over 50% Amid Brutal 2 Day Market Decline

As Wall Street tumbles on tariff fears, some online prediction markets share a growing certainty of a recession well before economists reach a consensus.

CryptoNews·2025/04/06 00:00

Liberation Day for Bitcoin Price – Is $100k Within Reach?

CryptoNews·2025/04/06 00:00

FARTCOIN’s Chart Resembles Textbook Bull Flag – Breakout or Consolidation?

CoinsProbe·2025/04/05 23:44

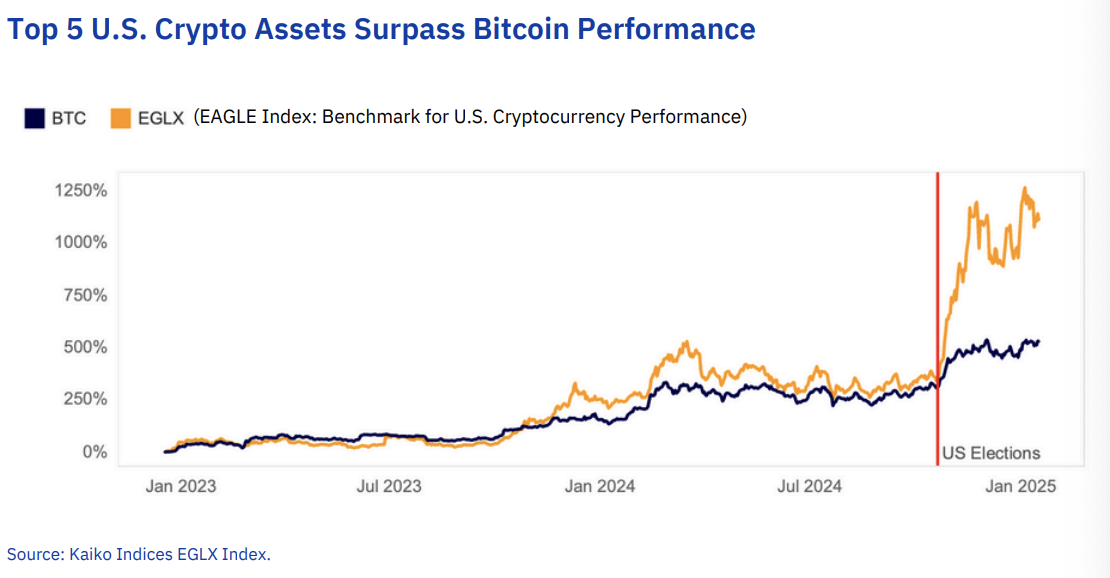

Altcoin volumes are ‘more concentrated’ than ever

Altcoin trade volume has returned to pre-FTX levels, but with a shrinking pool of market leaders

Blockworks·2025/04/05 18:57

Urgent Alert: Bitcoin ETF Outflows Hit $64.88M – Is This a Market Shift?

BitcoinWorld·2025/04/05 17:00

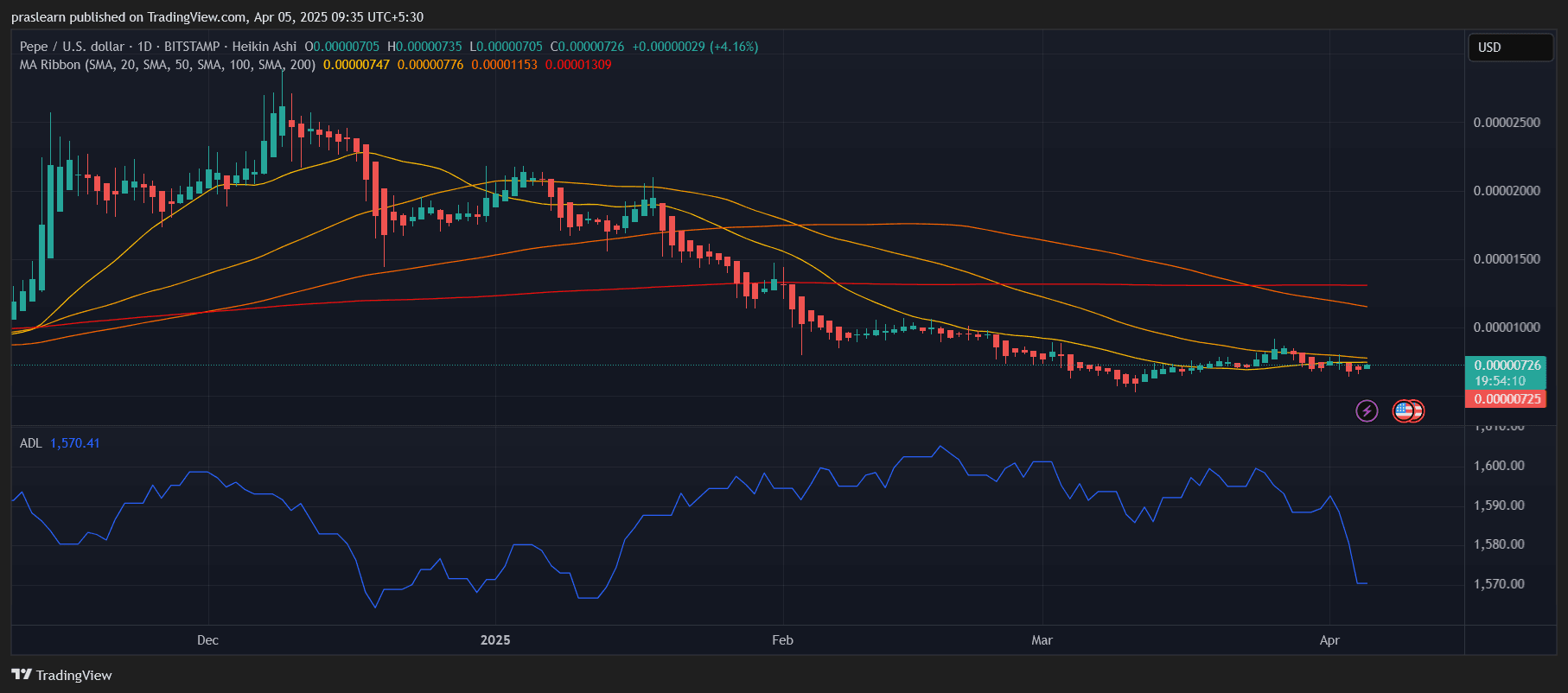

PEPE Price Poised for a Massive Rally?

Cryptoticker·2025/04/05 10:33

IMX Price Drops to 2-Year Low After 30 Million Tokens Are Sold; All-Time Low in Sight

Immutable’s price has dropped 40% in two weeks, reaching a 2-year low. With investor sentiment at a low, the price may continue to decline unless a recovery catalyst emerges.

BeInCrypto·2025/04/05 10:00

Solana Altcoin Saros Rises 1000% in March, Forms New All-Time Highs

Saros has rallied 1,024% since March, hitting new all-time highs, but with signs of overbought conditions, investors should watch for potential price corrections.

BeInCrypto·2025/04/05 09:30

Flash

- 19:37SOL fell below 110 dollarsThe market shows that SOL has fallen below 110 dollars, currently reported at 109.88 dollars, with a 24-hour drop of 7.23%. The market fluctuation is quite large, please manage your risk well.

- 19:36BTC falls below 80000 US dollarsThe market shows that BTC has fallen below 80,000 US dollars, currently reported at 79,976 US dollars. The 24-hour drop reached 3.72%. The market fluctuation is large, please manage your risk well.

- 19:35Mochi Inu was hacked, with a loss of about 50,000 US dollarsAccording to BlockSec, Mochi Inu suffered a hacker attack, losing about $50,000 in multiple transactions.